When buying a home, the biggest upfront expense is likely to be the down payment, which is typically between 3.5 and 20 percent of the home price. Even if future homeowners can reasonably afford monthly mortgage payments, the initial cost of making the entire down payment may be too much for them to pay on their own.

That’s where a down payment gift comes in — if a close friend or family member wants to chip in and help the prospective homebuyer purchase a home, they can do so. However, there are strict rules and regulations for such a transfer of cash. Here’s what you need to know.

Check your eligibility to use gift money for a down payment. Start here (Feb 27th, 2026)

How does using gift money for a mortgage down payment work?

“I see gift money becoming more popular, especially among millennials,” says Joann Perito, broker and owner of Avenues Unlimited. “Even if they make good money, because of large student loan amounts, it can be difficult for them to save for a down payment.”

In 2020, 58% of home buyers came up with their down payment primarily from their own funds. But this cost is often prohibitive, especially for first-time homebuyers who don’t have the benefit of funds from the sale of their current residence.

You can use gifted funds to make a down payment, but your mortgage lender will want to know some details before they allow you to use it. Only two specific groups can give a home buyer money to fund their down payment.

- Family members — as long as they can prove they have a standing relationship with the buyer. Sometimes the gift can come from a friend as well, but not all loan programs permit this.

- Government agency, non-profit, or other organization offering down payment assistance — as part of a program meant to get first-time buyers into the market.

Dos and don’ts of a down payment gift

|

Do… |

Don’t… |

|

Get a signed statement from the gift giver |

Tell the lender the funds are a gift when it’s a loan |

|

Remind gift giver to keep a paper trail |

Change or add money without explanation |

|

Get the money in advance and know how seasoned money works |

Assume all loan types allow down payment gifts |

|

Understand the monetary limit of gift funds for tax purposes |

Neglect the mortgage loan because you have no money in the game |

Check your home buying eligibility. Start here (Feb 27th, 2026)

Can you pay back a mortgage gift?

The answer is no. This is considered mortgage or loan fraud, which is a crime. It can also put your loan qualification at risk as all loans need to be factored into your debt-to-income ratio.

Perito has seen borrowers tell the lender their parents are gifting the money, but it’s actually a loan. “They expect their kids to pay it back eventually,” she says. “That can cause a problem because the lender has to take that into consideration for the debt-to-income ratio.”

The moral of this story: Be honest with your lender about where you’re receiving all funds for your down payment — they’ll likely find out anyway.

What else should you know about down payment gifts?

As previously mentioned, there’s a difference between receiving a down payment gift and a down payment loan. Buyers need to be clear with their mortgage lenders and confirm that the money received was gifted. A sudden infusion of cash without a traceable source will leave lenders suspicious and, perhaps, wary of completing the loan deal on their end.

Plus, you should talk with your lender to make sure you are reporting the gift properly to the IRS. The responsibility for this is on the borrower and gifter, as lenders are not required to report it.

Check your home buying eligibility. Start here (Feb 27th, 2026)

Tax implications of a down payment gift

As previously mentioned, family members have to pay a gift tax for anything over their limit of $17,000, or a collective $34,000 from parents who file taxes jointly. The person receiving the money doesn’t have to pay taxes.

If the donor wants to give more than $17,000, they can either pay taxes or claim the money as part of their $12.06 million lifetime exemption for gift taxes. However, this decision shouldn’t be taken lightly, especially if the donor hopes to pass on a hefty estate to their heirs later on. The $12.06 million exemption applies to taxes on these funds, so using up the value now could force family members to pay tax on whatever they inherit.

For borrowers interested in borrowing more without tax implications, there may be options involving separate gifts. Speak with a CPA if this applies to you.

Buying a home is more than a down payment

Ultimately, the cost of the down payment is only one expense to consider in the home-buying process. Homebuyers need to pay for closing costs, which include expenses like an appraisal, credit report, and underwriting fees.

“Many people these days have a hard time coming up with $1,000 to become a homeowner,” Perito says. “I always ask them where they’ll be getting money for the inspection, moving costs, and other expenses. I suggest to all my buyers that they have at least $4,000 in the bank before they buy a house.”

Down payment gifts can make it easier for homebuyers to afford a home

If you’re in the market for a new home and want a little help, don’t hesitate — just make sure you follow the above steps to ensure you accept such a gift in the proper manner. A gift can put homeownership in reach for plenty of aspiring homeowners.

When you speak with your lender about which loan program is best for you, be sure to let them know up front that you plan on using gift funds for the down payment. Some loan programs have strict guidelines about how much gift money you can use for a down payment and who can gift you the money.

Check your eligibility to use gift money for a down payment. Start here (Feb 27th, 2026)

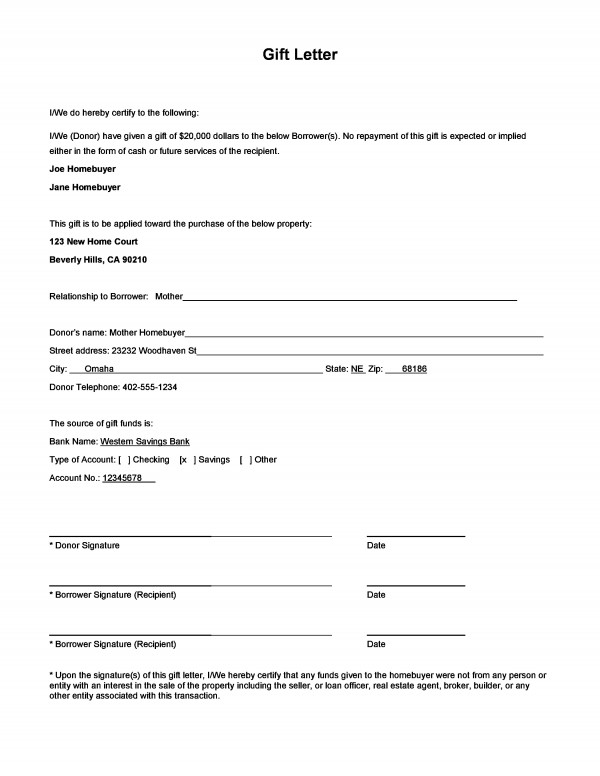

What is a gift letter?

A gift letter confirms the relationship between you and the gift giver

If you plan on getting gift funds from a friend or family member, you’ll need a gift letter confirming your relationship to the giver. The letter also must indicate that the money is a gift and that there is no expectation of repayment. Usually, the letter is signed by both interested parties.

The lender may also require further evidence of the gift — for instance, they may ask to see the gift-giver’s bank statements to show there are sufficient funds in the donor’s account to make the gift. They may also ask for a deposit slip or balance statement from the buyer’s account to show the down payment funds have been transferred.

Often gifts change hands during the application process. This allows time for the money to show up on both the giver and the buyer’s bank statements and for the mortgage lender to verify that the cash is from a legitimate source and the pair has an appropriate relationship.

If the gift funds are added to the buyer’s bank account after settlement, then documentation will still be required before it can be applied to the purchase. Typically, this will require a receipt of the cashier’s check as given to the closing agent.

Why do I need a gift letter?

You’ll need to provide a gift letter to your lender for a few reasons.

First, the lender wants to assess your debt-to-income ratio (DTI) accurately. With that, the lender wants to confirm with you that there is no expectation of repaying the gift money. If you were expected to repay the gift, that could significantly impact your DTI.

Second, government agencies want to confirm that the funds are legitimate and conform with all gift tax laws. Basically, the government wants to ensure that this gift money is not a part of a money-laundering scheme.

Check your home buying eligibility. Start here (Feb 27th, 2026)

Gift letter rules by loan type

Depending on the type of loan you are pursuing, there are slightly different gift letter rules. You’ll need to outline exactly how you are related to the gift giver in your letter with each loan type. Your loan officer should be able to provide you with the correct gift letter rules and format for your loan.

Here’s what you need to know about each.

VA loans

The VA loan allows eligible military service members and veterans to purchase a home with 0% down. If eligible, you can receive a gift for your home purchase from almost anyone. However, the gift cannot be from an interested party.

Interested parties would include a builder, developer, real estate agent, or seller. Essentially, anyone involved in your home sale transaction is not allowed to provide gift funds.

Check your VA home loan eligibility. Start here (Feb 27th, 2026)

Conventional loans

Conventional loans allow homebuyers to use gift money to cover a down payment and closing costs. The only caveat is that the funds must be from an acceptable source. Acceptable sources of gift funds include most family members.

Fannie Mae and Freddie Mac consider spouses, children, and dependents to be relatives. Essentially, anyone related to the borrower by blood, marriage, adoption, or legal guardianship can provide gift funds. Additionally, a fiance or domestic partner can provide gift funds.

Importantly, you cannot receive gift funds from someone involved in the transaction.

FHA loans

If buying a home with an FHA loan — a loan guaranteed by the Federal Housing Administration — then you can use gift funds from certain parties. As with a conventional loan, you can receive gift funds from a relative. Additionally, your employer, labor union, or close friend can offer gift funds. And of course, government agencies that provide homeownership assistance grants can provide gift funds.

Again, you won’t be able to accept gift funds from anyone involved in the real estate transaction.

Check your FHA eligibility. Start here (Feb 27th, 2026)

USDA loans

USDA loans help borrowers in rural areas achieve the goal of homeownership. As a borrower pursuing a USDA loan, you cannot receive gift funds from any interested parties.

But you may receive gift funds from family members and others who want to help.

Check your FHA eligibility. Start here (Feb 27th, 2026)

Down payment gift rules by property type

The use you have planned for the property will impact how gift funds can be used. Here’s what you need to know.

Primary residences

If purchasing a primary residence, the loan options above may all be on the table. Depending on the loan type, you can use gift funds to cover some or all of the down payment amount. Additionally, gift funds can be used to cover closing costs.

Secondary residences

If you are purchasing a secondary residence, your loan options are more limited. In most cases, you’ll have to pursue a conventional loan. With that, you can still accept gift funds. However, a lender may require you to contribute some of your own funds to supplement the gift when closing on a secondary residence.

Investment properties

In general, borrowers cannot use gift funds as a down payment on an investment property. Typically, investors will need to come up with at least 5% of the down payment out of their own pocket. But the rest can be a gift.

However, if you are using gift funds to support the purchase of an investment property outright, there are no explicit rules against that. Of course, you’ll need to abide by the tax rules surrounding gift limits. But if the gift is under the $17,000 limit, you may be able to use gift funds to help purchase an investment property outright.

How much money can I receive as a gift?

As of 2023, any one person can contribute $17,000 to any other one person without tax consequences, which could, for example, total as much as $34,000 to one child, if each parent contributes.

In many cases, there’s no limit on the dollar amount of gift money that can go into a down payment, as long as the buyer is purchasing a primary residence. However, if someone uses a down payment gift to buy a second home or investment property, they have to pay at least 5% of the down payment. The rest can be a gift.

What is seasoned money?

If possible, it’s a good idea to ensure gift money is seasoned when it comes time to funnel it into a down payment — this avoids the gift documentation needed, too. Lenders want proof that funds have been in the buyer’s account for a substantial amount of time to show that the buyer hasn’t just gathered a bunch of cash on a short-term basis.

Seasoned funds should sit in the buyer’s bank account for, ideally, two months before the buying process. So, if you received a $10,000 gift from your Aunt Mary three months ago to help you buy a house, then the bank probably won’t ask about it — this is seasoned money.

Check your eligibility to use gift money for a down payment. Start here (Feb 27th, 2026)

Down payment gifts FAQ

How do I write a gift letter for a down payment?

A gift letter will need to confirm the donor’s relationship to the buyer. Plus, it should verify that the donor does not expect any repayment of this gift.

And it can go something like this:

I, the gift donor, intend to gift $X amount to the gift recipient. The gift recipient is my (list relationship, such as son or nephew), and will use the funds as a part of their purchase of X property. I expect no repayment of this gift. The source of the gift funds is X.

The donor will need to sign off on the letter, which must be provided to your mortgage lender. Plus, the donor may want to include their phone number in case the loan officer has any questions.

How much can be gifted for a down payment?

Any amount can be gifted for a down payment. But as of 2023, parents can only contribute a combined $34,000 per child to help with a down payment, otherwise, the gift would be subject to a special tax. Other family members have a $17,000 lending limit before they also run into the gift tax.

Do all lenders require a gift letter?

Yes, all lenders will require a gift letter. Although you may have the funds, the lender needs to confirm that you won’t have to repay the gift. Plus, the lender must ensure that the funds came from a legitimate source.

What is a gift letter for a mortgage down payment?

A gift letter is a document that the borrower and donor will need to provide a mortgage lender in the application process if the applicant received gift funds to cover the down payment. The goal of a gift letter is to provide the lender with proof of where the funds came from. Plus, ensure that the funds do not have to be repaid.

Who should write a letter of explanation for a gift down payment?

The donor should write the gift letter to the lender. However, the borrower can help the donor craft a letter as long as the donor signs the document.

Can a mortgage gift be repaid?

The gift letter will have to explicitly state that the donor doesn’t expect repayment of the funds. With that, you cannot repay the donor.

What happens if you pay back a gift down payment?

If you pay back a gift down payment, after a gift letter explicitly stated that you would not, that will constitute mortgage fraud. With that, your home loan may be at risk.

Does a mortgage gift letter get reported to the IRS?

A mortgage gift letter that shows a gift of less than $17,000 might not be reported to the IRS. That’s because any gift below the $17,000 limit will not incur the gift tax. However, gift letters that involve a gift of more than $17,000 will likely be reported to the IRS. With that, the involved parties should be prepared to cover the gift tax.

Keep in mind that the limit will change each year.

Are there tax consequences for giving down payment gifts?

As of 2023, the gift tax will be levied on gifts of more than $17,000 per donor. With that, parents can gift an adult child $17,000 each in 2023 for a combined total of $34,000. After that threshold, the gift would be subject to a tax.

If you give a gift of more than the current limit, you should expect to pay taxes on the amount of the gift.

What is a gift of equity letter?

A gift of equity is when someone sells you a home for much less than it is actually worth. For example, a parent may sell a child a home worth $250,000 for $100,000. In this situation, the seller would have to provide the lender with a gift of equity letter. The letter would outline the exact amount of equity gifted. However, keep in mind that the gift tax still applies to the amount gifted through this option.

Check your eligibility to use gift money for a down payment. Start here (Feb 27th, 2026)